Saturday, 03 January 2009

Explanations, please?

Okay, can somebody explain this without invoking the usual backroom dealing and corruption?

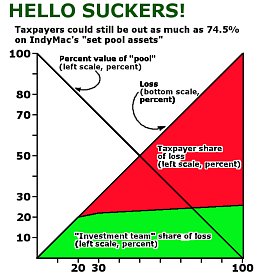

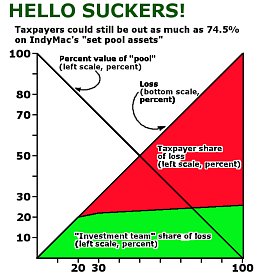

And then there’s the other shoe: Those “guarantees.†Not satisfied with a 90% margin on IndyMac’s “quantified (?)†assets, the “investment team†held out for federal– that means taxpayer, you know– protection against losses for another “unquantified†block, probably (the article doesn’t say) illiquid mortgage derivatives and the like. The new owners say they will generously accept the first 20% of any losses, but taxpayers get to make up all but a pittance of the rest... which can rise to as much as 74½ % of whatever “value†the FDIC dreams up.

you know– protection against losses for another “unquantified†block, probably (the article doesn’t say) illiquid mortgage derivatives and the like. The new owners say they will generously accept the first 20% of any losses, but taxpayers get to make up all but a pittance of the rest... which can rise to as much as 74½ % of whatever “value†the FDIC dreams up.

And this stuff is to be valued how? At “market� (No, that would be zero.) At “book (before disaster)� Hel-lo 74%! At some “best guess� And how are losses determined? If they aren’t based on the entire “set pool,†then this is just another way to privatize profits while sticking the public with the losses... and didn’t we just run ’round that bush with Fannie and Freddie?

All in all, at first glance (and even second glance) this looks to me more like a plan to funnel federal money to specific favored individuals than a way to restructure a bank. But I’ll admit that I’m just an ordinary clown who doesn’t “do†high finance. So maybe someone who does can explain where I got confused.

Elsewhere (added 090105 15:43):

------

Comments are disabled.

Post is locked.

Okay, can somebody explain this without invoking the usual backroom dealing and corruption?

WASHINGTON -- The Federal Deposit Insurance Corp. reached a preliminary agreement to sell the remains of IndyMac Bank -- one of the biggest bank failures in U.S. history -- to a team of high-profile investors, suggesting there is private money willing to invest in troubled banks if the government agrees to shoulder heavy losses.So Soros, Paulson, Flowers, Dell, and friends are getting almost $14 billion assets for a bit less than 10 cents on the dollar. That feels like a typical fire-sale ratio, although it would have been nice if, for something worth $14 billion, the FDIC could have held out for a better price: Was the only choice to give Soros, etal a $13 billion gift from the taxpayers? Couldn’t they find somebody who would have paid, say, $2 billion?

The investment team, which includes affiliates of private-equity chieftain Christopher Flowers, hedge-fund investors George Soros and John Paulson, and computer mogul Michael Dell, will contribute $1.3 billion in capital toward a purchase of IndyMac Federal Bank, valued by the FDIC at $13.9 billion, which is the amount of deposits, loans, securities, branches, and other assets to be held by the bank on Day 1.

The complex terms also include seller financing that could take the form of Federal Home Loan Bank loans and other sources...

[... Then, 12 paragraphs, and a jump to page A6 later...]

As part of the deal, the FDIC agreed to share future losses on a set pool of IndyMac assets...

...IndyMac will assume the first 20% of losses on these assets, which the FDIC wouldn’t quantify until the deal closes. The FDIC will absorb 80% of the next 10% of losses, and then 95% of losses on the remainder of the portfolio. - The Wall Street Journal [1]

And then there’s the other shoe: Those “guarantees.†Not satisfied with a 90% margin on IndyMac’s “quantified (?)†assets, the “investment team†held out for federal– that means taxpayer,

you know– protection against losses for another “unquantified†block, probably (the article doesn’t say) illiquid mortgage derivatives and the like. The new owners say they will generously accept the first 20% of any losses, but taxpayers get to make up all but a pittance of the rest... which can rise to as much as 74½ % of whatever “value†the FDIC dreams up.

you know– protection against losses for another “unquantified†block, probably (the article doesn’t say) illiquid mortgage derivatives and the like. The new owners say they will generously accept the first 20% of any losses, but taxpayers get to make up all but a pittance of the rest... which can rise to as much as 74½ % of whatever “value†the FDIC dreams up. And this stuff is to be valued how? At “market� (No, that would be zero.) At “book (before disaster)� Hel-lo 74%! At some “best guess� And how are losses determined? If they aren’t based on the entire “set pool,†then this is just another way to privatize profits while sticking the public with the losses... and didn’t we just run ’round that bush with Fannie and Freddie?

All in all, at first glance (and even second glance) this looks to me more like a plan to funnel federal money to specific favored individuals than a way to restructure a bank. But I’ll admit that I’m just an ordinary clown who doesn’t “do†high finance. So maybe someone who does can explain where I got confused.

Elsewhere (added 090105 15:43):

American Thinker: Look Who’s Buying IndyMac

------

[1] The article is behind a subscriber wall; the link points to preview version. The quotes come from the Saturday/Sunday January 3-4, 2009 front page. It is “interesting†that the online version of the article omits the phrase hilited in green above.

Posted by: Old Grouch in

Rants

at

19:49:30 GMT

| Comments (1)

| Add Comment

Post contains 566 words, total size 5 kb.

Posted by: Carteach0 at 01/05/09 11:13:28 (rwo+p)

69kb generated in CPU 0.6376, elapsed 0.7475 seconds.

52 queries taking 0.7249 seconds, 162 records returned.

Powered by Minx 1.1.6c-pink.

52 queries taking 0.7249 seconds, 162 records returned.

Powered by Minx 1.1.6c-pink.