Monday, 22 September 2008

Why parents aren’t scared when their kids go steampunk:

People think of goths as weirdoes who take vampires too seriously, and therefore they can’t help being worried on some level that a crazy goth might, you know, want to make them bleed. Whereas steampunks are — what? Weirdoes who take pocket-watches too seriously? What are they gonna do, vehemently tell you what time it is? - Five Thoughts On the Popularity of Steampunk

Relatively harmless. Well, mostly harmless.

Via: KF, where there’s a discussion of organizing the Steam Scouts

Merit badges in robotics, dining room etiquette and competitive croquet...

Posted by: Old Grouch in

Linkage

at

17:41:25 GMT

| No Comments

| Add Comment

Post contains 100 words, total size 1 kb.

Sunday, 21 September 2008

Yes, I know the banner is gone. Its template has vanished mysteriously. Search parties have been sent out. More later.

UPDATE 21:24: Now it’s back, but the file isn’t visible in my template list. I wonder — should I say “thanks,†or “WTF?â€.

Posted by: Old Grouch in

Beta

at

16:33:19 GMT

| No Comments

| Add Comment

Post contains 45 words, total size 1 kb.

A: THAT’S NOT FUNNY!!!

So I open my inbox to find an e-mail from The Sibling. Seems that one of her associates is searching for a campaign item, a button sported by the Indiana delegation at the RNC.

Buttons are the hot item at the Republican National Convention. The Alaskan button reads, “From the coldest state comes the hottest vice president.†But [Indiana State] Sen. Sue Landske and some fellow Hoosiers came up with a button of their own: “Hoosiers for the hot chick.â€

Pat Koch from Santa Claus, Indiana likes it.

“Being a hot chick, strong fun and capable all go together,†said Koch, who said she wouldn’t see anything sexist even if a man were to don the button.

“We’ve been selling them at five dollars for hurricane victim relief and we’ve sold 250 of them,†said Sen. Landske.

At this point I must regretfully confess that, political junkie though I be, this is one aspect of Palin-o-mania that managed to escape my notice.

more...

Posted by: Old Grouch in

Rants

at

00:33:53 GMT

| No Comments

| Add Comment

Post contains 1079 words, total size 13 kb.

Saturday, 20 September 2008

Philip Stott:

The Green movement has become dangerous for the survival of our society. It is surely time to stop pandering to its often ridiculous whims and fancies. We have been far too kind to its utopianism. Politicians of all parties have become enfeebled by indulging its fanaticism and unrealistic proposals, especially on food and energy. This has led to inertia, and to a serious failure to act when action is urgently required...Generation capacity in the U.K. will actually decline by 23 gigawatts by 2020, thanks largely to government pandering to “green†activists. And things are not all that different in this country.

Whether they’re communists, utopian socialists, Malthusians, or just stupid is beside the point. We must stop giving the “greens†a pass for having “good intentions,†and start holding them accountable for all the consequences of their policies.

Via: BTB

Related:

If it works, I want to offer a wager

Mark Philip Alger’s global warming posts

Posted by: Old Grouch in

Linkage

at

17:06:59 GMT

| No Comments

| Add Comment

Post contains 178 words, total size 3 kb.

“Defenseâ€

“Militaryâ€

Same space, different spin.

Posted by: Old Grouch in

The Press

at

15:35:05 GMT

| No Comments

| Add Comment

Post contains 13 words, total size 1 kb.

Friday, 19 September 2008

Posted by: Old Grouch in

In Passing

at

16:33:44 GMT

| Comments (1)

| Add Comment

Post contains 28 words, total size 2 kb.

Thursday, 18 September 2008

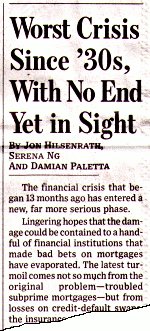

Zachary Karabell has an opinion piece in today’s Wall Street Journal that, if accurate, goes a long way toward explaining how we got to where we are in the current banking crisis. His thesis: It’s “the revenge of Enron:â€

The collapse of Enron in 2002 triggered a wave of regulations, ...[including changes in]... accounting rules that forced financial service companies to change the way they report the value of their assets (or liabilities). Enron valued future contracts in such a way as to vastly inflate its reported profits. In response, accounting standards were shifted by the Financial Accounting Standards Board and validated by the SEC. The new standards force companies to value or “mark†their assets according to a different set of standards and levels.

...Beginning last year, financial companies exposed to the mortgage market began to mark down their assets, quickly and steeply. That created a chain reaction, as losses that were reported on balance sheets led to declining stock prices and lower credit ratings, forcing these companies to put aside ever larger reserves (also dictated by banking regulations) to cover those losses.

In the case of AIG, the issues are even more arcane. In February, as its balance sheet continued to sharply decline, the company issued a statement saying that it “believes that its mark-to-market unrealized losses on the super senior credit default swap portfolio . . . are not indicative of the losses it may realize over time.â€...

What AIG was saying then, and what others from Lehman to Bear Stearns to the world at large have been saying since, is that the losses showing up aren't “real.â€

Now I’ll be the first to admit that “I don’t understand all that I know†about this level of accounting. (I have enough trouble keeping my checkbook balanced, and pay somebody else to do my taxes). But I can at least buy this part of his argument, because

it make sense: Current value of an asset is relatively meaningless, unless you’re trying to sell that asset right now.

it make sense: Current value of an asset is relatively meaningless, unless you’re trying to sell that asset right now. Obviously, that isn’t absolutely true (what about your Enron stock, hmmm...?). But haven’t we been told, time and again, that this is the rule behind buy-and-hold investing? You buy on fundamentals, ignore the transient ups-and-downs, and plan on selling out later (often years later) at a nice profit.

The value of the underlying assets -- homes and mortgages -- declined, sometimes 10%, sometimes 20%, rarely more. That is a hit to the system, but on its own should never have led to the implosion of Wall Street. What has leveled Wall Street is that the value of the derivatives has declined to zero in some cases, at least according to what these companies are reporting.But the current rule requires companies to account for derivatives at those “market†prices, and the companies had signed on to other agreements that relied on the resulting figures. The combination has produced a cascading failure similar to what happened to those who bought stocks on margin just before the 1929 crash: Mousetrapped by a momentary downward spike in prices, they had to sell out, forcing prices (and market confidence) down even more.

There's something wrong with that picture: Down 20% doesn't equal down 100%. In a paralyzed environment, where few are buying and everyone is selling, a market price could well be near zero. But that is hardly the “real†price.

So is mark-to-market a bad thing? Karabell spends several column-inches to explain how AIG’s “complex and opaque†business model was difficult to understand, and how the pricing of “derivatives based on derivatives†was even more complex. (To me, that’s a red flag right there: What’s the old saying, “never invest in a business you don’t understand?â€) Then he argues that all this complexity militates against regulation:

Legislators and agencies would be wary of passing rules regulating how a semiconductor chip is programmed [Ha! Only because they haven’t thought of it yet! -o.g.]; they would recognize that while the outcomes those chips produce might be simple, the way they produce them is not.Karabell obviously has more faith in the wisdom of legislators (and their regulatory-agency minions) than I, but his point that stupid regulation screws up markets remains valid. But as long as the markets are being bailed out with public money, some form of regulation will be there.

Enron deceived investors by pricing its futures contracts artificially high. Today we have all these firms whose assets consist of complex financial instruments that, in compliance with FASB rules, may be priced artificially low. Those instruments will ultimately be worth... what? Is it even possible to predict a current value based on future expectations? When we unwind all the computer models and complex calculations, doesn’t it mean, bottom line, trusting that something is worth what someone else says it is?

Right now the market isn’t trusting any of the numbers, and I defy the “smart people†to write a regulation that would give us numbers that the market would trust. We’re pretty safe in accepting that zero isn’t accurate, but, here and now, what is? And if we’re going fudge the numbers, how can we insure that the fudging we do is equally fair to buyers and sellers (or borrowers and lenders)? Short answers: We don’t know, and we can’t.

Not that there isn’t opportunity...

A few years from now, there will be a magazine cover with someone we’ve never heard of who bought all of those mortgages and derivatives for next to nothing on the correct assumption that they were indeed worth quite a bit.But that “someone we’ve never heard of†will have most likely been risking his own money.

The complete WSJ article:

Posted by: Old Grouch in

In Passing

at

16:52:44 GMT

| No Comments

| Add Comment

Post contains 949 words, total size 8 kb.

Wednesday, 17 September 2008

From Ars Technica:

Customs and Border Patrol agents can grab your laptop, BlackBerry, or external hard drive without needing so much as a reason, but a new bill introduced last week to Congress would at least put some limits on how border searches could be done.The bill wouldn’t eliminate arbitrary searches, but it

...requires the government to draft additional rules regarding information security, the number of days a device can be retained, receipts that must be issued when devices are taken, ways to report abuses, and it requires the completion of both a privacy impact study and a civil liberties impact study. Travelers would also have the explicit right to watch as the search is conducted.The sponsor is a Democrat, Loretta Sanchez of California.

The bill doesn’t stop (or even limit) Customs’ “no reason†searches (so the national security paranoids shouldn’t object). What it does is give the search-ees some assurance that their data won’t be disseminated to the four winds, and that they’ll eventually get their stuff back. It also requires some reporting, so we can find out how much of a problem this actually is.

It’s a no-brainer. Hey Republicans, where are you?

Elsewhere:

Ars Technica: Laptop searches at the border: No reason? No problem!

Previously: Why worry?

Posted by: Old Grouch in

In Passing

at

15:04:48 GMT

| No Comments

| Add Comment

Post contains 217 words, total size 3 kb.

Tuesday, 16 September 2008

VO:

just push that big red switch, reformat and load Ubuntu,

then pop open a cool one, and lean back...

Because you deserve it!â€

Via: c|net via Engadget via Dustbury

Posted by: Old Grouch in

In Passing

at

19:40:04 GMT

| Comments (1)

| Add Comment

Post contains 51 words, total size 2 kb.

“It’s not often that one person plays key roles in two -- count ’em, two -- trillion-dollar disasters.â€

Via: Insty, who also notes Gorlick’s connection with the Duke rape hoax.

Posted by: Old Grouch in

Linkage

at

16:09:28 GMT

| No Comments

| Add Comment

Post contains 39 words, total size 1 kb.

53 queries taking 0.0668 seconds, 226 records returned.

Powered by Minx 1.1.6c-pink.